R&D Tax Credits with ADP

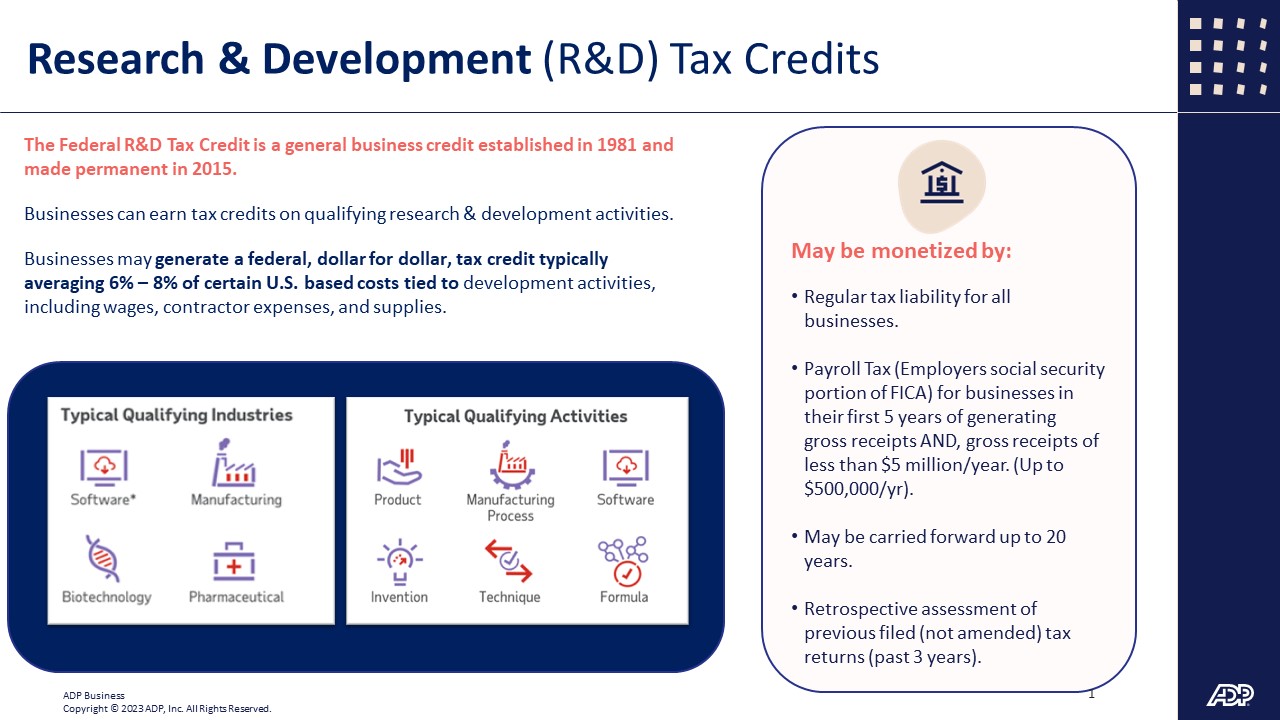

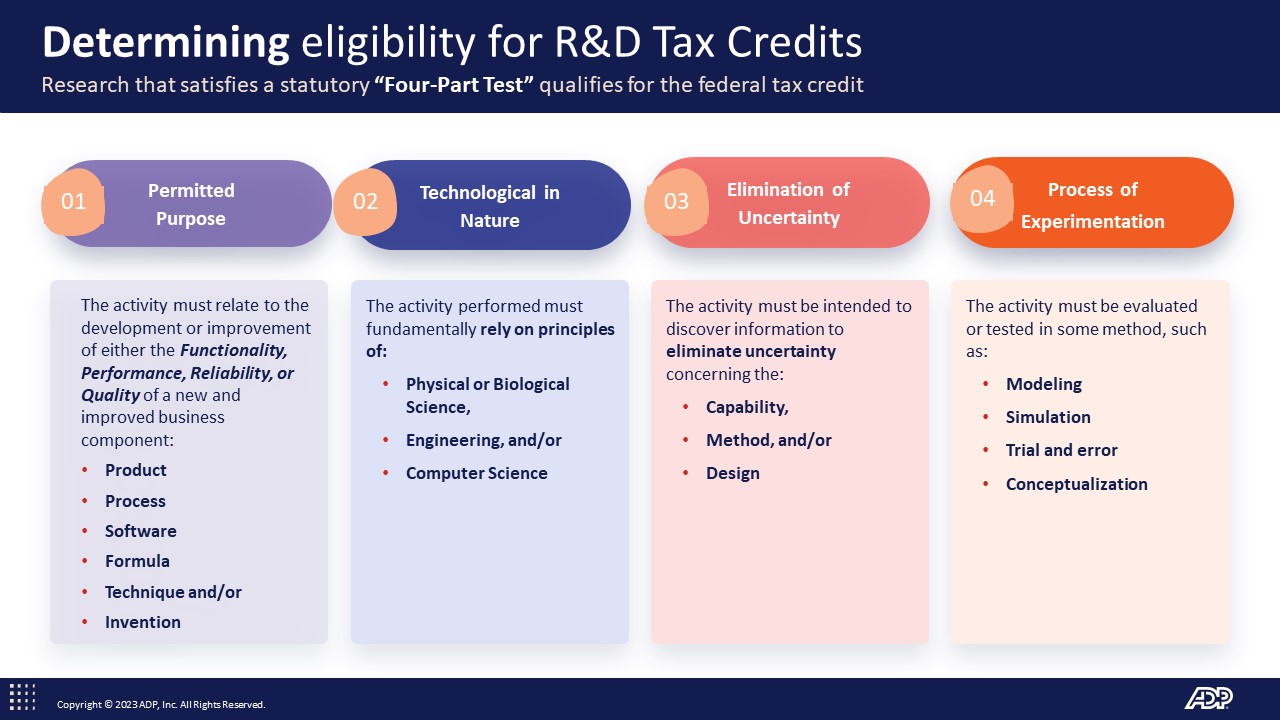

SmallBusiness.CEO, in collaboration with our partners at ADP, offers a transformative approach to uncovering Research and Development (R&D) tax credits that your business may be eligible for but unaware of. Our process begins with a comprehensive assessment of your company’s activities, innovations, and expenditures, ensuring that no potential credit goes unnoticed. Leveraging ADP’s expertise in payroll, HR, and tax compliance, we meticulously analyze your operations to identify qualifying R&D expenses that align with government regulations and tax incentives.

Once the eligible expenditures are identified, SmallBusiness.CEO and ADP work hand in hand to navigate the complex landscape of R&D tax credits, ensuring that your business maximizes its potential returns while remaining fully compliant with tax laws and regulations. Our collaborative approach combines cutting-edge technology with human expertise, providing you with a tailored strategy to optimize your tax position and unlock valuable savings. Whether you’re a startup pushing the boundaries of innovation or an established enterprise investing in research and development, our partnership with ADP ensures that you harness every available opportunity to fuel your growth and innovation initiatives.

Furthermore, SmallBusiness.CEO and ADP offer ongoing support and guidance throughout the entire R&D tax credit process, from initial assessment to claim submission and beyond. Our dedicated team of experts remains committed to providing personalized assistance, answering your questions, and addressing any concerns that may arise along the way. With our combined resources and industry-leading insights, you can rest assured that your business is in capable hands, poised to capitalize on untapped opportunities and propel your innovation agenda forward. Partner with SmallBusiness.CEO and ADP today to unlock the full potential of your research and development endeavors and drive sustainable growth for your business.